Earned Wage Access. And so much more.

Make every day payday and improve employee financial well-being, productivity, and retention. 1

Trusted by 3.8M+ employees accessing over $15 billion in earnings

Empower your employees to thrive –

at zero cost.

From accessing their pay right as they earn it to empowering employees to thrive, we offer a wealth of benefits your people will love:

- Same-day pay to access earned wages

- Balance Shield to help monitor your account balance 2

- Money saving tool to reach financial goals 3

- Special offers and discounts – just because they work for you

- EWA industry’s first and only free credit monitoring to help build financial well-being

Employees can enjoy all these great benefits without any mandatory costs, hidden fees or interest rates - and at no cost you.

Up your recruiting game

Keep employees happy and productive

Retain employees longer

An employee benefit that sets you apart

With people regularly borrowing from loved ones, or using payday loans, offering pay-time flexibility and free credit monitoring as a standard benefit demonstrates your commitment to your employees' financial well-being.

76%

of financially stressed employees are attracted to another company that they feel cares about their financial wellbeing. 5

“We reviewed several EWA solutions, but EarnIn’s was the easiest to deploy as there was zero integration required with our payroll services, and some associates were already using the Earnin app regularly for more flexibility in accessing their paychecks.”

- Shawn Handrahan, CEO, Valet Living

Why work with us

Zero technical integration Unlike other vendors, we don’t require any technical integrations, upgrades or ongoing IT maintenance so you can get going in as few as 10 days.

Zero-touch, zero-cost, zero-risk operations EarnIn doesn’t require any funding or changes to your business operations. It’s a voluntary benefit and we fund 100% of the cash. You have nothing to lose.

Secure, confidential, compliant Privacy and security are our top priorities. We securely connect to employee bank accounts and are compliant with laws across all 50 states. We never sell personal or employment information.

Unique employee benefits – at no cost to you Your employees can enjoy special discounts and unique benefits just because they work for you. And the more employees sign up, the bigger the benefits to them – and to you.

We’ve got your back

Dedicated support Your dedicated partner success manager will help you measure the impact of your program and provide ongoing support for future promotions. All employee support is handled directly through EarnIn — no additional support from your team is needed.

Actionable insights We’ll provide actionable insights based on aggregate usage and anonymous survey data so we can improve your program together.

Turnkey program We provide everything you need to launch and promote your EarnIn program, including customized marketing materials for your employees and internal communications channels.

As seen on

“We had taken a look at several companies and EarnIn was the only one that didn't require an integration with payroll or our scheduling system. EarnIn was by far the easiest company to implement.”

- Deanna Keppel, VP of Support Services, Assisting Hands

It's easy to get started:

-

01

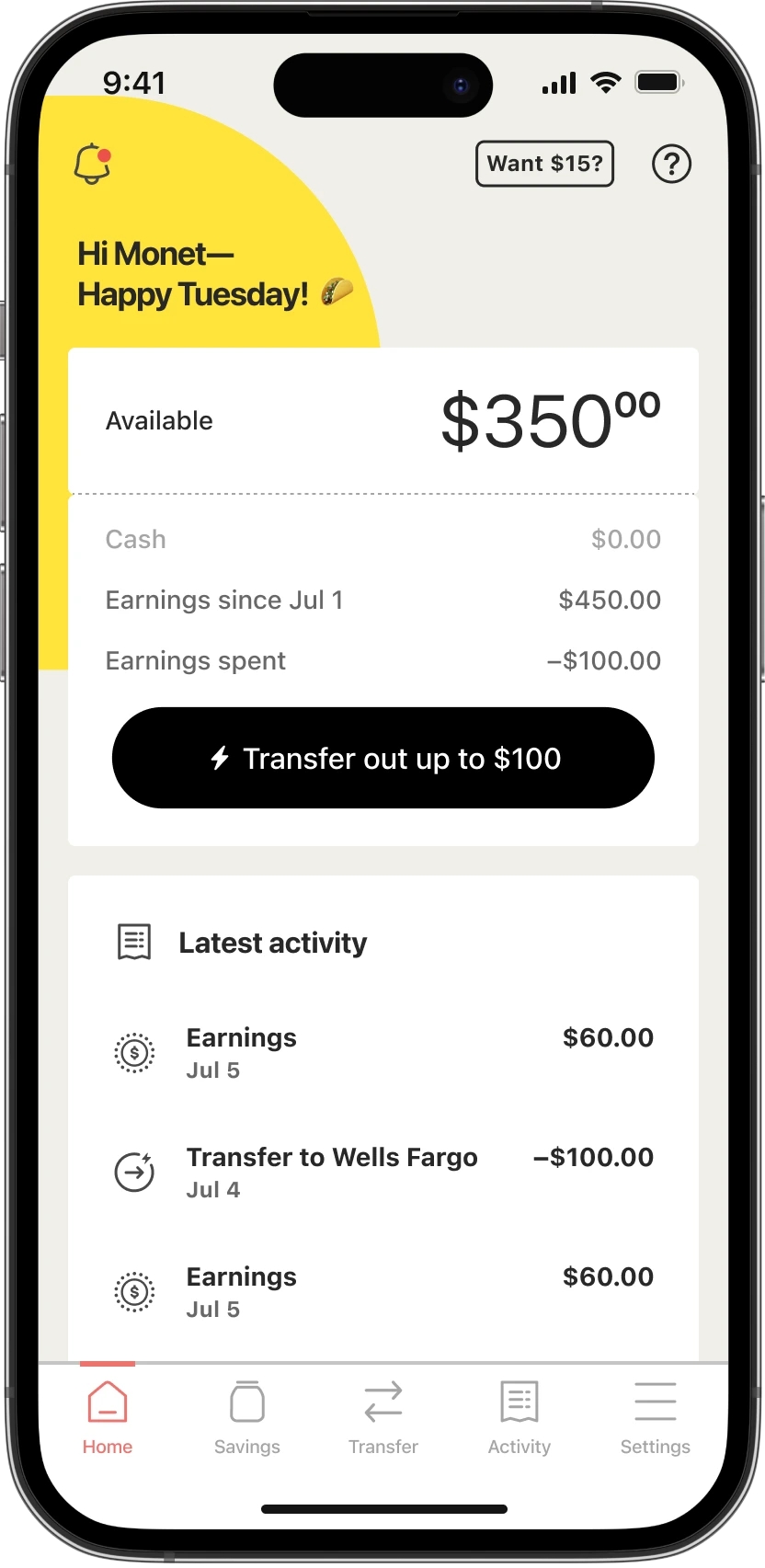

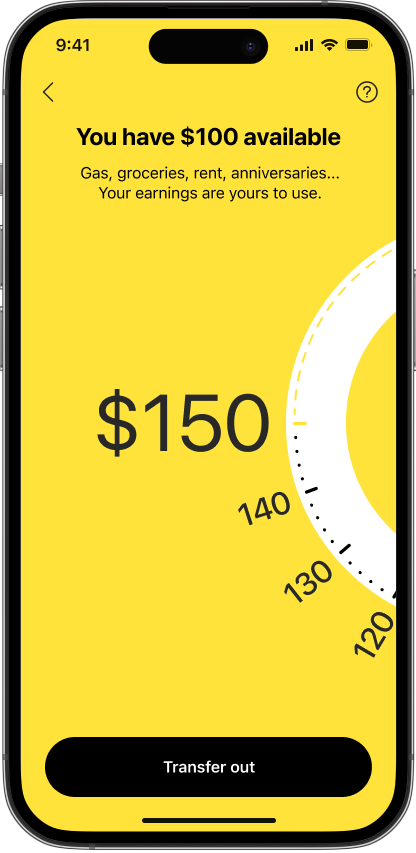

When employees add their bank and employment info, we verify their paycheck.

-

02

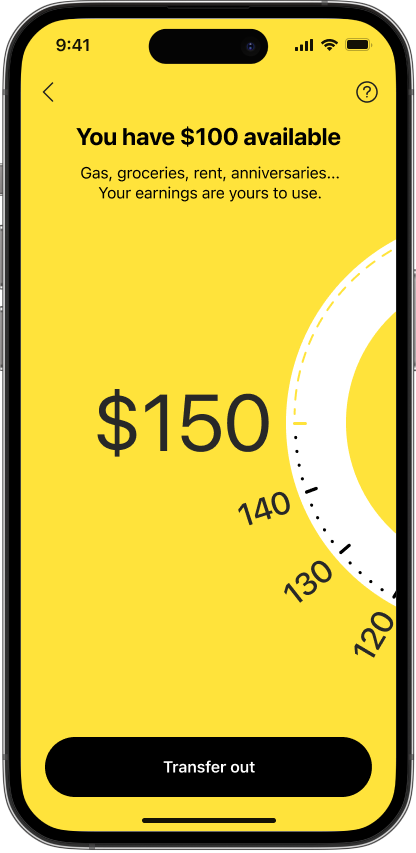

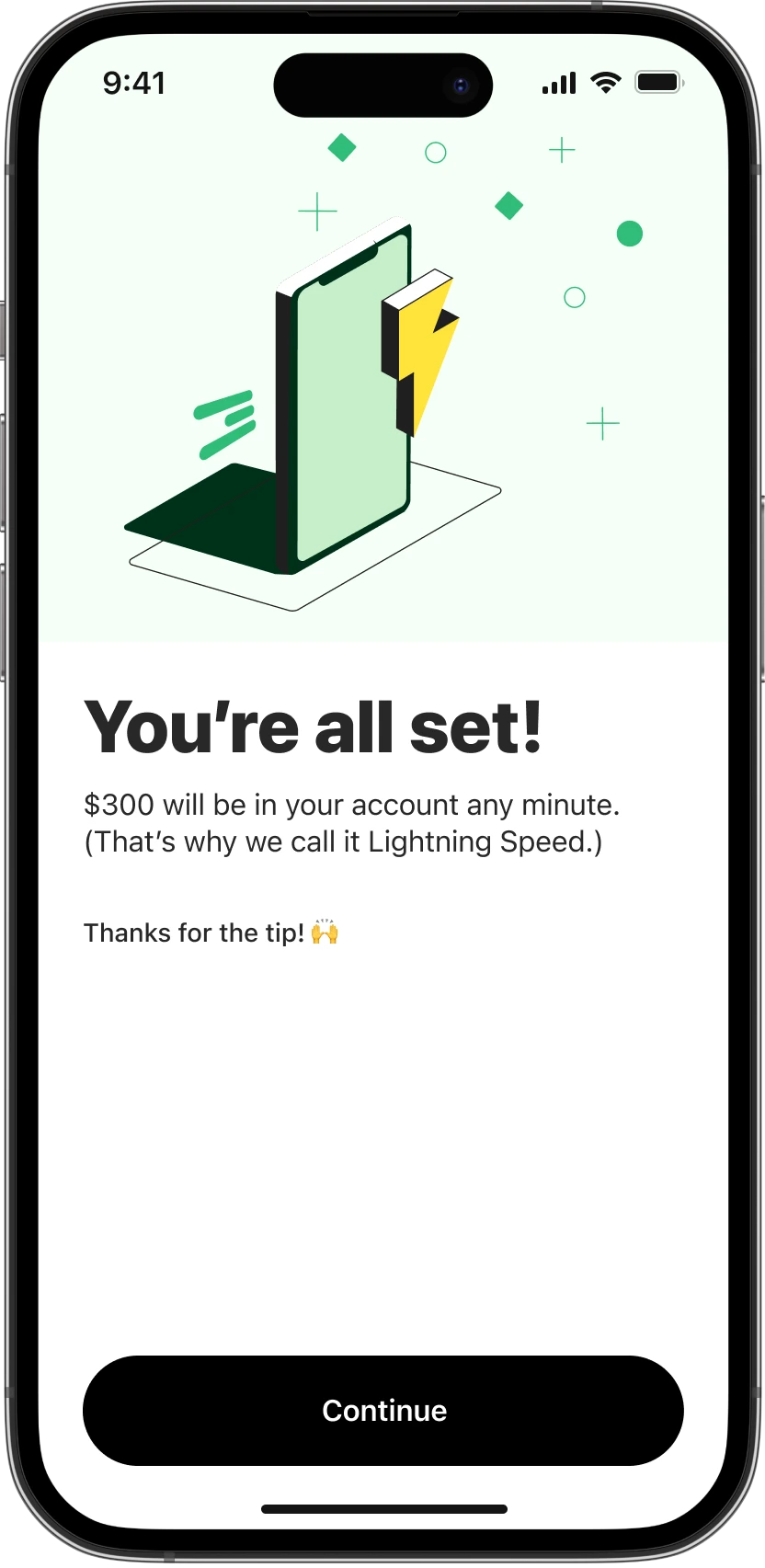

They can transfer up to $150/day [up to $750/pay period] to their linked bank. 1

-

03

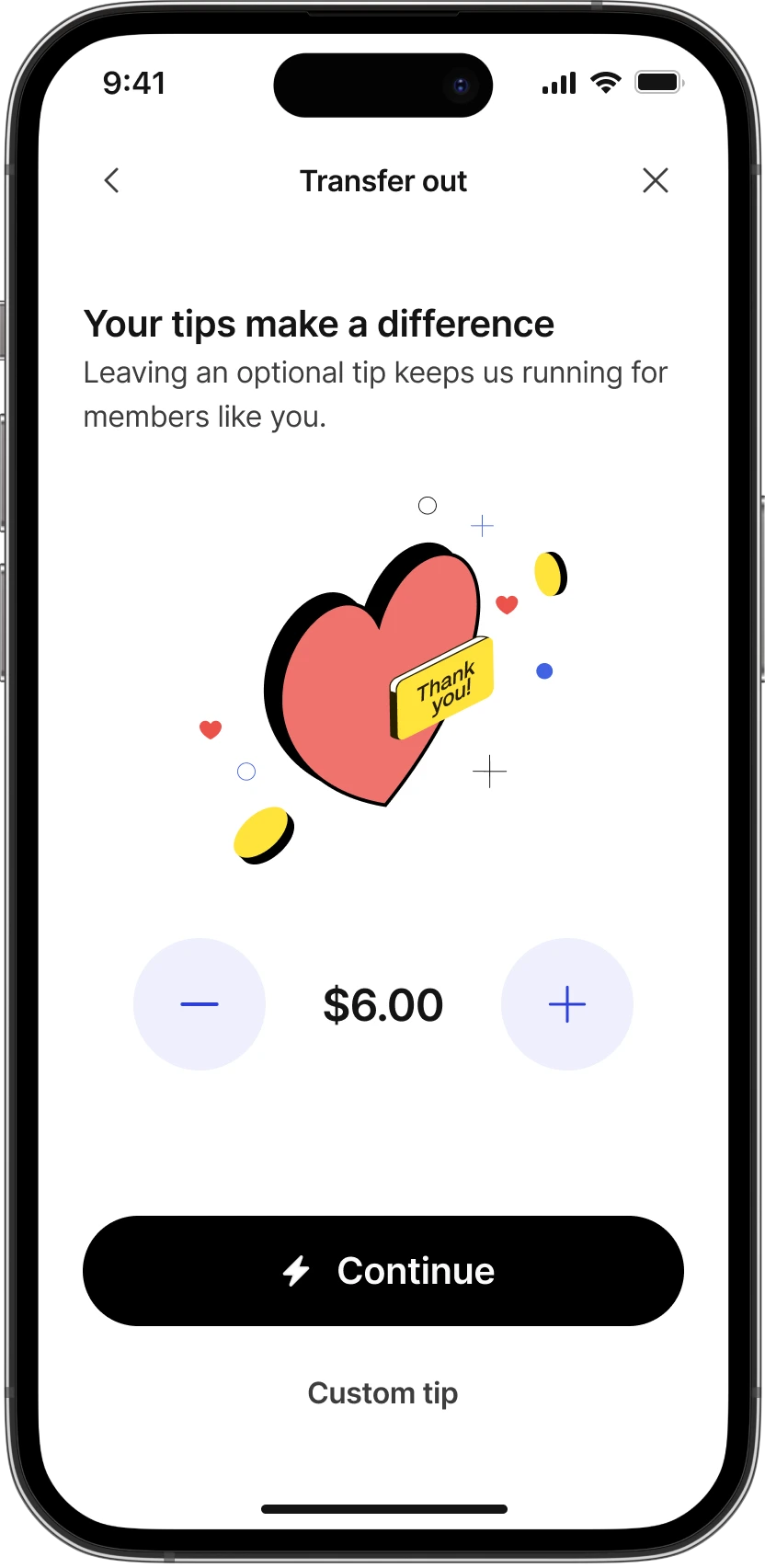

Your employees have an option to tip (if they like).

-

04

Any earnings you used (plus tips) get debited when your paycheck hits.

-

05

They can even monitor their credit score and view weekly changes to their credit for free. 6

*Actual amount may vary and build over time depending on member’s EarnIn account history, pay amount and other risk-based factors. At the time of signup, their starting amount will be lower, but over time they may become eligible for a higher limit of up to $150/day or up to $750/pay period based on the above-mentioned factors. Their available amount will be displayed within the EarnIn mobile app and may change at any time, at EarnIn’s discretion.

*Actual amount may vary and build over time depending on member’s EarnIn account history, pay amount and other risk-based factors. At the time of signup, their starting amount will be lower, but over time they may become eligible for a higher limit of up to $100/day or up to $750/pay period based on the above-mentioned factors. Their available amount will be displayed within the EarnIn mobile app and may change at any time, at EarnIn’s discretion.

Schedule a Demo

See how you can make EWA part of your competitive advantage today.

*Required field.

For more information, please visit Privacy Policy.