Your credit score, or credit rating, is your ticket to nearly everything in the financial world, from loans to mortgages to credit cards. To get approved for a loan or credit line, you’ll need an active and long-standing credit report that shows a history of on-time and good-faith payments as well as a good credit rating.

It seems simple enough, but how do you start to build credit in the first place?

If you have no credit, learning how to build credit without a credit card may seem impossible — but it’s not. Here’s what you need to know.

Can you build a credit score without a credit card?

The short answer? Yes.

There are many ways to build your credit score without a credit card (more on those below), but you can damage your credit too — especially if you’re not paying on time or your accounts are delinquent or turned over to a collection’s agency. In those situations, knowing how to calmly deal with financial stress is a major help for getting things back on track.

Building credit without a credit card is also essential if you need to fix or repair your credit after an unfortunate run.

How long does it take to build your credit score with no history or credit cards?

Building credit, especially with no history, can take time. That’s true whether or not you have credit cards in your name.

You’ll need a history of accounts in good standing and on-time payments (if possible). You can achieve this with a solid mix of financial options like loans (student, federal, and otherwise), service accounts, and more. Knowing when credit scores update can also help.

What if I have no credit history?

In some situations, no credit history will be treated the same as a bad credit score, meaning no approvals for loans or credit lines. That’s because no credit and bad credit are both considered risky by lenders and creditors. But that doesn’t mean you are optionless.

The good news is that there are many ways to build credit with no credit history. We’ll discuss all the different avenues below.

Can you build credit with a traditional debit card?

Since debit cards pull money directly from your checking or savings accounts and have nothing to do with borrowed funds, they have no effect on your credit score. No debit account activity gets reported to credit bureaus, even when paying rent.

8 ways to build credit without a credit card

If you don’t have a credit history, you’ll want to start building your credit as soon as possible. It will help when you’re ready to buy a home or car, take out lines of credit, or borrow money.

Here are a few ways to start building your credit without a credit card:

1. Credit builder loan

You might have difficulty getting approval for a traditional loan, but a credit builder loan is still an option. Lenders place the loan money into a secured account, and you make monthly payments toward the borrowed amount. Once you pay it off, you receive the loan funds. Your payments and activity are reported to credit bureaus, helping build your credit.

2. Secured Loan

Another way is to pursue a secured loan, which utilizes collateral. Typically, the item you’re purchasing, like a property or vehicle, is put up as collateral. This means that if you default on the loan, the creditor or lender can seize and resell the asset to recover losses. This can help you build credit at the possible cost of losing the asset. To apply for a secured loan, you must provide a work history and proof of active employment.

3. Secured credit card

Secured credit cards are backed by collateral, like secured loans. In this case, the collateral is a set amount of money you deposit into the account, determining your available credit. So, if you deposit $500, your credit limit is $500. It functions similarly to a debit card, but your activity is reported to credit bureaus to help build your credit.

4. Credit reporting service

Service accounts like rent payments or utility bills aren't reported to credit bureaus. Still, you can use a third-party service like Experian Boost to build credit.

5. Personal loan

Personal loans are usually smaller in comparison to a mortgage or business loan. They also tend to have higher APRs, so lenders are more willing to offer them.

6. Auto loan

If you need a car, consider applying for an auto loan with a low-to-medium interest rate. Paying auto loans can help build your credit like any other loan, and lenders are more likely to approve you.

7. Repay existing loans

Paying off existing loans, like student loans or smaller personal loans, also helps build your credit. If you already have a loan, it’s a matter of paying it down on time and being patient.

8. Become an authorized user

Similar to a co-signer for a loan, as an authorized user, you’re attached to someone else’s line of credit. It doesn’t rely on your credit rating, but your activities are still reported as if the credit card was your own.

What’s the simplest way to build credit?

Of all the possible ways to build credit without a credit card in your name, becoming an authorized user is the fastest and easiest. It does require someone to add you to their existing credit account, which isn’t an option for everyone. Also, make sure you understand the advantages and disadvantages of a credit card.

The next best option is using a credit reporting service like Experian Boost to report bills you already pay.

No cards? No problem

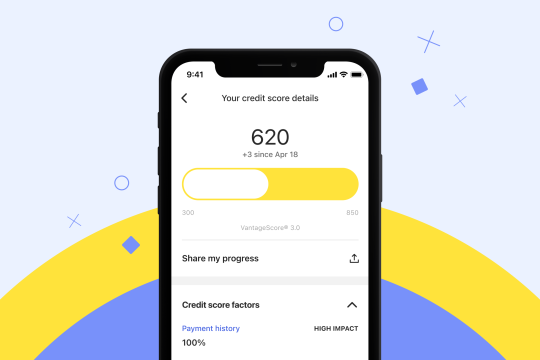

If you want to improve your credit, keeping a close eye on your credit report is a must. By reviewing your credit score frequently and consistently, you’ll know exactly where you stand.

That’s where the EarnIn app comes in handy. EarnIn’s free Credit Monitoring tool lets you keep a close eye on your credit score anytime, for free.

And EarnIn’s advantages don’t stop there. Our Cash Out tool lets you access your pay as you work — not days or weeks later. You can get up to $100 a day and up to $750 every pay period with no credit checks, no interest, and no mandatory fees.

EarnIn not only acts as a safety net for unforeseen emergencies or urgent expenses, but it’s great for timing your everyday expenses, giving you the flexibility you need to reach your goals.

Download the EarnIn app today and experience money at the speed of you.

Please note, the material collected in this post is for informational purposes only and is not intended to be relied upon as or construed as advice regarding any specific circumstances. Nor is it an endorsement of any organization or services.

You may enjoy

EarnIn is a financial technology company not a bank. Subject to your available earnings, Daily Max and Pay Period Max. EarnIn does not charge interest on Cash Outs. EarnIn does not charge hidden fees for use of its services. Restrictions and/or third party fees may apply. EarnIn services may not be available in all states. For more info visit earnin.com/TOS.